- Local Spend

- S$1 = 1.5 miles or 1.5% cashback

- Overseas Spend

- S$1 = 2.2 miles or 2.2% cashback

- when you pay the Card's Annual Fee

- 25,000 Bonus Miles

- Local Spend

- S$1 = 1.3 Miles

- Overseas Spend (made in foreign currency)

- S$1 = 2.2 Miles

- On Travel Spend at Agoda

- S$1 = Up to 4.3 Miles

- at yuu merchants, with no min. spend and no cap

- S$1 = 10X yuu Points

- when you spend S$600 Qualifying Spend at yuu merchants in a calendar month

- Additional bonus 26x yuu Points

- on all other spend

- S$1 = 1X yuu Point

- at yuu merchants, with no min. spend and no cap

- S$1 = 10X yuu Points

- when you spend S$600 Qualifying Spend at yuu merchants in a calendar month

- Additional bonus 26X yuu Points

- on All Other Spend

- S$1 = 1X yuu Point

Existing Cardmembers can get S$60 cashback when you successfully apply for a DBS yuu American Express Card and make a min. spend of S$300 within 30 days of card approval. T&Cs apply.

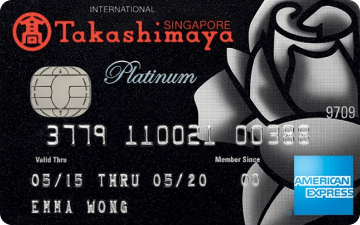

- for every S$10 spend at Takashimaya

- 2 Taka Bonus Points

- Additional Discount during Sale Events at Takashimaya

- 10%

- CashCard top-up when you spend $400 at Taka

- S$4

AA.png)