How to Apply for and Use a Credit Card in Singapore

Want to apply for a credit card in Singapore but you're not sure which bank to go for – Citibank, Standard Chartered, American Express, DBS, and many more? Or maybe, as someone who’s forgotten to pay their telephone bill on occasion, and even misplaced important documents like your passport and work permit, you're concerned that this could wreak havoc on your finances, or land you into a cycle of debt. Fret not, MoneySmart is here to answer all your questions related to credit card application requirements as well as showing you how credit cards work.

How do Credit Cards Work?

A credit card offers you the option to make purchases now and pay later. Think of it as a bank loaning you money to make payments in-store and online, and allowing you to pay the sum back at a later date. Credit cards often come with points accrual programs for you to exchange credit card points for gifts and rewards.

Advantages of having a credit card

Maximize your spending

Responsible credit card usage and spending habits enable you to get the most out of your purchases. Using a credit card allows you to gain from every purchase through benefits like points and cashbacks you wouldn’t otherwise get with transactions.

Opportunity to build credit score

Proper and responsible use of your newfound spending power allows you to build your credit score. Lowering your credit utilisation, via a higher credit limit, for example, can also help. The better your score is, the easier it gets for you to apply for loans in the future.

Earn rewards such as cashback or miles points

Do you like the idea of accumulating rewards for every dollar spent? Some cards provide cashbacks, rewards points, or mileage points for everyday purchases, while others offer significant discounts and flexible payment options.

Increased purchasing power

Maximum credit limit refers to what you aren't allowed to spend beyond, i.e. a credit limit of $20,000. Now, this may seem exciting as your purchasing power has now increased by $20,000. However, one should observe responsible spending to maintain a good credit score.

Accessibility and convenience

Credit cards allow you to enjoy online or in-store shopping without the hassle of cash. You can purchase anything within your credit limit simply by swiping or tapping your card. You'll also receive monthly statements to help you keep track of your expenditure.

Want to Find Out More About the Best Credit Cards in Singapore?

Different Types of Credit Cards

There are a variety of options when it comes to choosing a credit card. The 3 most popular types of credit cards in Singapore are air miles, rewards, or cashback cards. Take your time to make Singapore credit card comparisons and familiarize yourself with selecting the right one for your needs.

Types of Credit Cards in Singapore

Compare the best credit cards in Singapore with MoneySmart

Compare all of Singapore's best cashback, rewards, air miles, petrol, buffet, grocery, or student credit cards and more.

Want to Find Out What the Best Air Miles, Cashback, and Rewards Cards Are?

Air Miles Credit Cards

Best Air Miles Credit Cards Singapore

Cashback Credit Cards

Best No Minimum Spend Cashback Credit Cards In Singapore

Rewards Credit Cards

Best Rewards Credit Cards - Singapore

Air Miles Credit Cards

The 7 Best Air Miles Credit Cards in Singapore

Cashback Credit Cards

11 Best Cashback Credit Cards in Singapore

Rewards Credit Cards

The 7 Best Rewards Cards in Singapore

How to Choose the Best Credit Card for You?

What will you use the credit card for? What are your spending habits? To help you make the right choice, think about these factors.

Factors to consider when choosing a Credit Card

Lifestyle and spending habits

Are you a frequent traveler? Do you dine in often? Evaluating your lifestyle and understanding your spending habits will help you choose the right card that will best complement your needs.

Sign-up bonus

A lot of credit cards offer special bonuses when a new user meets a specific requirement. For instance, receive 85,000 air miles when you spend $4,000 in the first 3 months. Consider this: can you comfortably spend this amount in this time frame? If not, you won’t be getting any of the bonus at all.

Rewards

You can find credit cards that offer fixed percentages for their rewards program, and even offer higher percentages for specific categories like 5% cashback for gas transactions

Annual fee

Credit cards usually require an annual fee, although some companies waive this annual fee during the first one or two years to make it attractive for you to switch over. Evaluate for yourself if it’s worth paying, considering that it probably comes with several perks you can maximize to offset the cost. It’s also good to note that your bank can arrange for an annual fee waiver. Your bank will check your credit card usage and payment history before waiving the fee. So, make it a habit to always pay in full and on time.

Annual Percentage Rate (APR)

This refers to the interest rate you have to pay if you have balance outstanding. Some credit cards offer low promotional APR initially, which then eventually rises after you’ve had the card for a year or more. Thankfully, you won’t have to worry about APR if you’re punctual in fully paying your credit card every month. Full payment is important, as merely paying the minimum amount and rolling over your balance to the next month negates any rewards or cash back you've earned since you will be paying high-interest rates.

Is There A Right Credit Card For You? Our MoneySmart General Manager weighs in

Compare Credit Cards with Us

When comparing credit cards in Singapore, it’s best that you seek out unbiased opinions to help you decide. You may want to gather more information by checking out reviews from personal finance comparison sites. Comparing different credit cards from different banks may be a bit challenging if you do it on your own.

A site like MoneySmart allows you to view all the available credit cards in Singapore and compare them at a glance, making it easier to select which card suits you. Plus, you can sign up online through MoneySmart directly and save yourself the hassle of going to the bank.

How Do You Know Which Credit Card is Best for You?

Cashback Credit Cards

Best Unlimited Cashback Credit Cards in Singapore

Credit Cards with no Annual Fee

Best Credit Cards with No Annual Fee in Singapore

Credit Card Tips

4 Questions to Ask Before You Apply for That Credit Card

Best Credit Cards in Singapore

7 Best Credit Cards in Singapore – MoneySmart Writers Pick Our Favourites

Credit Card Comparison

Air Miles vs Cashback vs Rewards – Which is the Best Credit Card Type to Use?

Credit Card Comparison

Visa vs Mastercard vs American Express – Which is Best?

How to Apply for a Credit Card in Singapore

Banks in Singapore have a thorough process for screening first-time credit card applicants. Here’s what you need to know about the application process and requirements you need to fulfill for a smooth application.

Are You Eligible for a Credit Card?

Now that you’ve narrowed down your choices and you’re ready to get your first credit card, let’s have a look at how banks evaluate your application.

Minimum Age

You must be at least 21 years old and above to qualify.

Required Minimum Annual Income

You should earn at least $30,000 -$50,000 annually to qualify. You must also have a stable source of income to pay your credit card obligations. In addition, you may need to submit some official documents, such as your latest income tax notice and payslip.

Good Credit History

Take note that some credit cards require specific minimum years of good credit history before you can apply.

What is the process?

Once you’ve decided on which card to get, it’s time to go through the credit card application process.

Visit your chosen bank’s website or head to the nearest branch near you to sign up. You can also check out if they have other channels for application, such as affiliate sites and aggregators like MoneySmart. Take note of the necessary documents and prepare them for submission.

Complete the questionnaire or application form to help the bank or service provider evaluate your financial standing and eligibility.

Submit the documents. Different banks may require different sets of required documents, but the basic requirements they usually ask to submit are as follows: A copy of your NRIC/FIN or Passport, Proof of income (e.g. latest computerised payslip, Income Tax Notice, CPF statements), and Proof of billing.

Prepare yourself for the verification process, which may be made via a phone call.

Wait for your credit card application to be processed and approved. Once approved, your credit line will be opened, and your new card will be delivered to your place of residence.

Activate the credit card either through a verification SMS or phone call, or using your bank’s website, mobile app, or ATM.

What You Need to Know Before Using Your Credit Card

The benefits of a credit card are best enjoyed when you use it responsibly. Understand and plan your payments to use your newfound purchasing power wisely.

What Are the Common Credit Card Fees & Understanding What It Means

Finance Charge

This is also known as credit card interest, which you’ll be subjected to if you fail to pay your bills in full. Make every effort to avoid this, since it can get expensive in the long run.

Late Charge

Always take note of the due date so you can avoid paying late fees, as it can hurt your credit score. Some banks allow a 1-day grace period considering that some payment methods, like cheques, take some time to process.

Annual Fees

This is basically the subscription fee for using the credit card. Such fees typically rate at an average of about $192.60. Depending on how often you use your card, you can ask the bank to waive this fee.

Foreign Transaction Fee

This refers to the extra charge you need to pay when you purchase something overseas—payments processed by a foreign bank or in a currency other than SGD. Typically, this runs at 2.5%-3.5% of your transaction amount.

Understanding credit card minimum payment

Understanding credit card interest rates

Usually, the interest rate in Singapore is either 25.9% or 26.9% per annum. If you fail to pay your bill in full, you will incur an interest rate of more than 2% per month. For example, if you have an outstanding balance of $2,000, you will have to pay the bank $40 in credit card interest. To avoid these hefty interest payments, make sure to pay your credit card bills in full and on time.

What Else Do You Need to Know About Credit Card Fees?

Credit Card Tips

5 Ways to Deal With Late Payment Fees on Your Credit Card

Credit Card Tips

Credit Card Transaction Fees You Probably Don’t Know You’re Paying

Credit Card for Overseas Spending

7 Best Credit Cards in Singapore for Overseas Spending

Credit Card Tips

0% Interest Instalment Payment Plans: What Your Bank Isn’t Telling You

Credit Card Tips

What You Need to Know About the Annual Fees for Singapore’s Most Popular Credit Cards

Credit Card with No Annual Fee

Best Credit Cards with No Annual Fee in Singapore (2021)

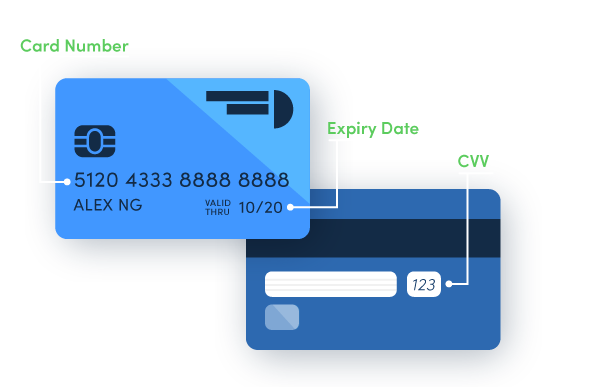

Knowing the parts of your credit card

Card Number

This consists of up to 16 digits and serves as the identifying number of the credit card. The number is stored in the card’s magnetic strip. So, when the card is swiped for purchases, the number immediately supplies information about the credit card network and issuer to the merchant.

Expiry Date

Keep in mind that all credit cards have an expiration date. The expiry date indicates when it’s time to get a new card, which will have a new expiry date and CVV (Card Verification Value) code. In some cases, it can also have a new account number.

CVV

This is a 3- to 4-digit code located at the back of your credit card. It serves as a fraud-prevention tool when making purchases that don’t require the physical card, such as when online shopping.

How to activate your credit card

SMS or Card Activation Hotline

- You’ll find a number and information on how to activate your credit card through SMS verification or a phone call with the letter that came with your new card. Some banks provide the instructions on a removable sticker on the card itself.

Mobile Banking App

- You can activate your credit card via your bank’s mobile app. Find the ‘Credit Card Settings’ option on the app. You will be guided through the credit card activation process.

Bank’s Online Website

- Alternatively, you can activate your credit card through your bank’s website. Simply log in to your account and find your way to the ‘Credit Card Activation and PIN Set’ option and follow the instructions.

ATM

- You can head to your respective bank’s ATM. Insert your new card and input the PIN. Select ‘Activate Card’ in the menu and follow the instructions to complete your activation.

How to Use Your Credit Card Wisely & Securely

With increased purchasing power comes great financial responsibility. Check out some tips below to help first-time credit card users make better decisions.

Tips on How to Use your Credit Card Wisely

Only spend what you can afford to pay off monthly

Owning a credit card doesn’t mean you have unlimited money. Before you swipe your card, make sure that you have the budget and ability to pay off your monthly credit card bill. If possible, use it sparingly and only when needed.

Pay your monthly bill in full

As much as possible, pay off your monthly credit card bills in full. In the event that you can’t, try to pay as much as you can and meet the minimum payment amount to avoid late payment penalties. However, the outstanding balance will still incur high interest rates that may invalidate the rewards or cashbacks you’ve earned for that month.

Use your rewards

Many credit cards have minimum spending requirements that you have to meet before you can redeem the rewards or cashbacks you’ve earned. Some reward points also come with expiry dates. Make sure to track and use your accumulated points and keep an eye on your bank’s promotions to maximize your credit card benefits.

Pay your bills on time

Increase your credit rating by paying your bills early or on time. This will also help you avoid incurring any additional fees, helping you better handle the flow of your finances.

3 Ways to Pay Your Credit Card Bill in Singapore

This is the most accessible credit card payment mode, especially when you already have a savings account under the same bank. Online banking allows you to make same-day transactions, so you don’t have to worry about late charges when you make last-minute payments.

For those who often make the mistake of paying bills late, consider automating payments from your savings account using GIRO (General Interbank Recurring Order), an electronic payment service. You can set a minimum or full amount of GIRO deductions before the due date.

If your savings account is parked under a different bank from your credit card's, you can use AXS to pay your credit card bills. You can make payments at AXS stations, online through the AXS e-Station website, or using the AXS m-Station mobile app.

Exclusive: Most Popular Credit Cards in Singapore

MoneySmart has helped over 3 million users find the best credit cards in the market. Curious to know what people searched for? Find out in this members-only report and get insights on which card you can apply for next! Plus, try out our personality quiz to find which card matches your taste!

Tips on How to Use your Credit Card Securely

Never disclose your credit card information to anyone

Never share the financial information on your card and your personal details with anyone, including your close friends or family, for security purposes.

Never give out your personal information

Personal information includes your old bills and documents. Dispose of them properly and avoid sharing bank account information with anyone to avoid identity theft and unauthorized purchases.

Check the transaction history in your monthly bill

Make it a habit to check your transaction history every month. This shows how in tune you are with your spending plan and allows you to discover any suspicious activity.

When using your card to shop online, look for the green lock icon or https

The green lock and HTTPS tag in the address bar indicates that the website you’re accessing is secure and that the data being transmitted between your device and the site is encrypted. If the website isn’t secure, you should avoid it and not risk having your information exposed.

Don’t open suspicious-looking emails and links

Scams are everywhere these days. Don’t fall victim to one; ignore unwanted or unsolicited emails or texts, especially those that offer promos that appear too good to be true.

Manage Your Credit Card Wisely and Establish Good Credit

Owning a credit card is one of the ultimate tests to see if you have your finances together and whether or not you’re capable of making responsible financial decisions. Having a credit card is a privilege, so make sure to practice healthy spending habits to maximize the benefits they can provide.

Enjoyed reading our guide on credit card application in Singapore? Now that you’re well-versed in credit card application requirements and everything to do with credit cards, it’s time to review all available credit cards in Singapore so you can make an informed decision. Otherwise, if you have any queries on personal finance, do contact us via our contact form and we’ll get back to you as soon as we can.

Find the best Credit Card for your needs

Which credit card should you apply for? Visit MoneySmart to compare and apply for the best credit card to suit your lifestyle and spending habits.