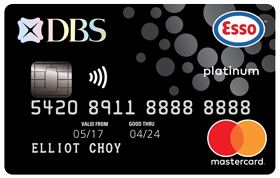

DBS Esso Card

- Up to 23%

- Fuel Savings at Esso

- 1 Smiles Point

- per S$10 charged outside of Esso

- 1 Smiles Point

- per 1 Litre of Synergy Fuel

Online Promo

Get S$120 Cash Rebate when you apply and spend S$180 on fuel per month for 2 consecutive months from card approval date. T&Cs apply.

Are you eligible?

- Min. S$180 nett fuel spends per month at any Esso station in Singapore for all 2 months from the date of Card approval

What you need to know

- S$120 fuel savings is given in the form of cash rebate credited to the DBS Esso Card when Spend Criteria is met.

All Details

Disclaimer: At MoneySmart.sg, we strive to keep our information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products and services are presented without warranty. Additionally, this site may be compensated through third party advertisers. However, the results of our comparison tools which are not marked as sponsored are always based on objective analysis first.