We found 8 DBS Credit Cards for you!

- on Online Purchases

- S$5 = 10 DBS Points (equivalent to 4 Miles per S$1)

- on Overseas Purchases

- S$5 = 3 DBS Points (equivalent to 1.2 Miles per S$1)

- on All Other Purchases

- S$5 = 1 DBS Point (equivalent to 0.4 Miles per S$1)

Online Promo

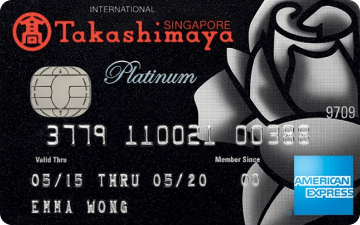

Frequent Shoppers at Takashimaya

- for every S$10 spend at Takashimaya

- 2 Taka Bonus Points

- CashCard top-up when you spend $400 at Taka

- S$4

- Additional Discount during Sale Events at Takashimaya

- 10%

Online Promo: Valid until 30 Apr 2024 - See more details below

Get S$150 cashback when you successfully apply and make a min. spend of S$250 within Takashimaya, within first month from card approval date. T&Cs apply.

Online Shopping

- On Online Purchases

- S$5 = 5 DBS Points (2 Miles per S$1)

- On All Other Purchases

- S$5= 1 DBS Point (0.4 Miles per S$1)

- e-Commerce Protection for Online Purchases

- Complimentary

Online Promo

Shopping and Transportation

- on Shopping & Transport Spend

- Up to 6% cashback

- Min Spend

- S$800

- Cashback Cap

- Up to S$70

Online Promo: Valid until 31 May 2024 - See more details below

Get S$388 cashback when you apply and make the min. spend of S$800 within 60 days of card approval. T&Cs apply.

Online Promo

Miles or Cashback – you decide

- Local Spend

- S$1 = 1.5 miles or 1.5% cashback

- Overseas Spend

- S$1 = 2.2 miles or 2.2% cashback

- Min. Spend per month

- S$0

Online Promo: Valid until 31 May 2024 - See more details below

Get up to 85,000 miles (for New Cardmembers) or up to 40,000 Miles (Existing Cardmembers) when you sign up and make a min. spend of S$4,000 within 30 days of card approval and payable annual fee required. T&Cs apply.

- on Golden Village, McDonald's & streaming services

- 5% Cashback

- On All Other Spend

- 0.3% Cashback

- Spending Cap

- S$500

Online Promo

Earn Miles That Never Expire

- Local Spend

- S$1 = 1.3 Miles

- Overseas Spend (made in foreign currency)

- S$1 = 2.2 Miles

- On Travel Spend at Expedia & Kaligo

- S$1 = Up to 10 Miles

Online Promo: Valid until 31 May 2024 - See more details below

Get up to 60,000 miles when you apply, pay the card's annual fee and charge a min. spend of S$3,000 within 60 days from card approval date. T&Cs apply.

Online Promo

Earn Miles That Never Expire

- Local Spend

- S$1 = 1.3 Miles

- Overseas Spend (made in foreign currency)

- S$1 = 2.2 Miles

- On Travel Spend at Expedia & Kaligo

- S$1 = Up to 10 Miles

Online Promo: Valid until 19 May 2024 - See more details below

Get up to 53,000 miles when you apply, pay the card's annual fee and charge a min. spend of S$3,000 within 60 days from card approval date. T&Cs apply.

(1).jpg)

AA.png)